Which Best Describes A Regressive Tax?

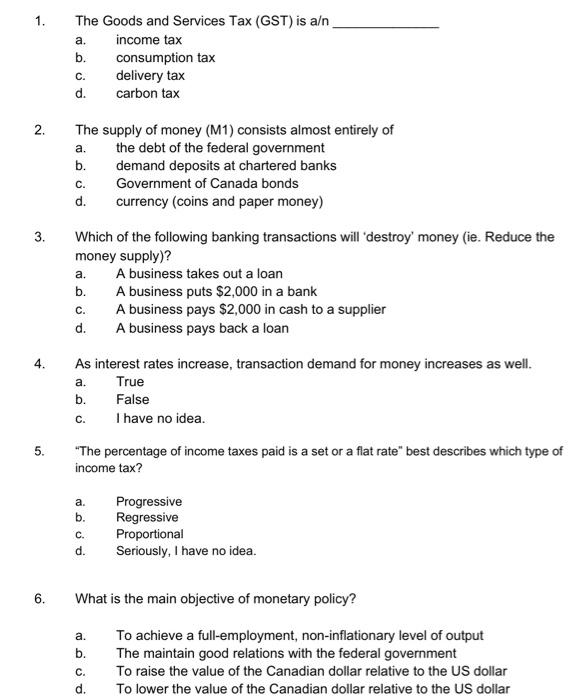

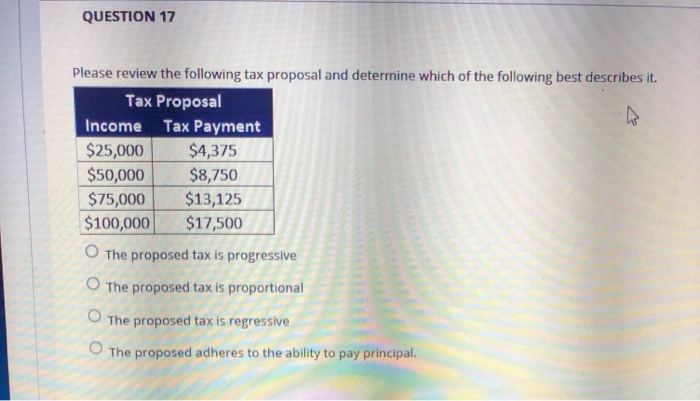

Which best describes a regressive tax?. Which sentence best describes a regressive tax. Who is paying the tax. To reduce pollution the _____ legislates and enforces regulations that.

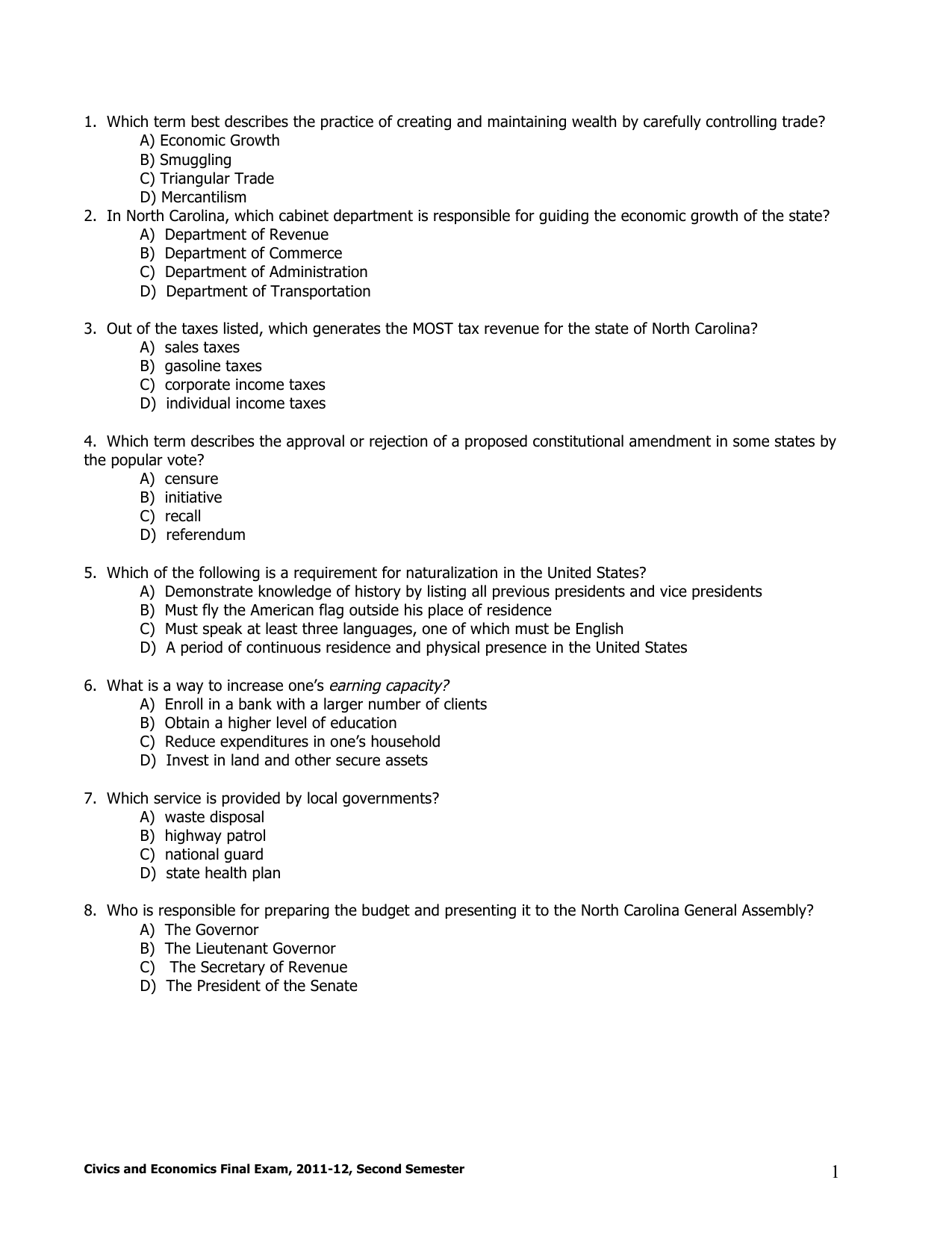

No government services could create inflation which decreases the purchasing power of consumers. If you earn 100 paying 1 as tax doesnt mind a lot to you but if you earned 10 it would mind much more. To fund government programs.

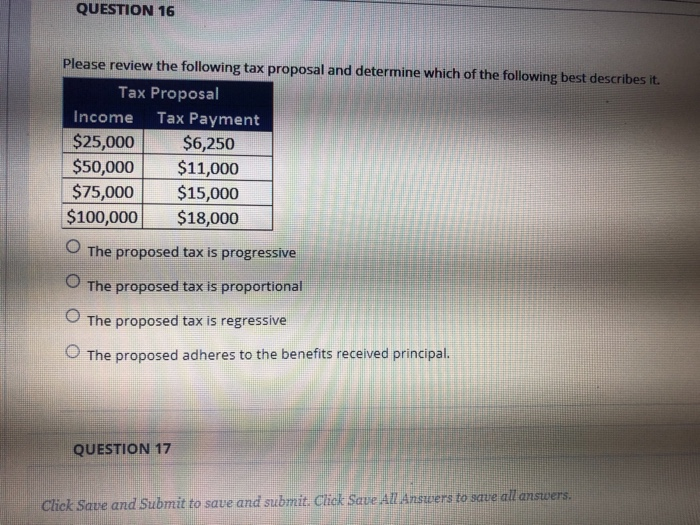

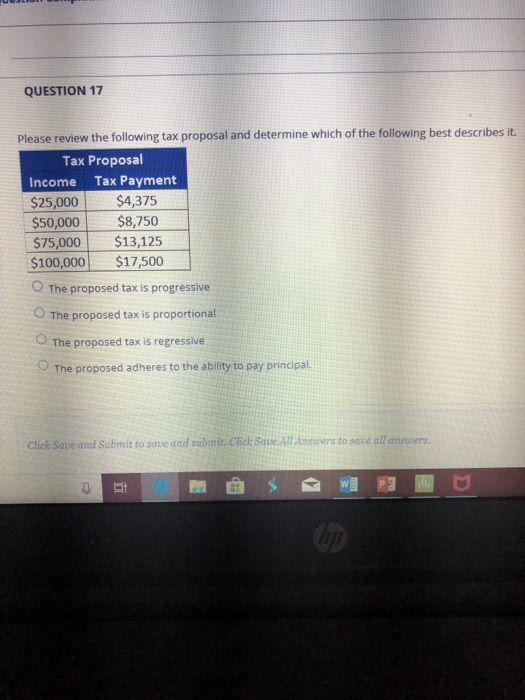

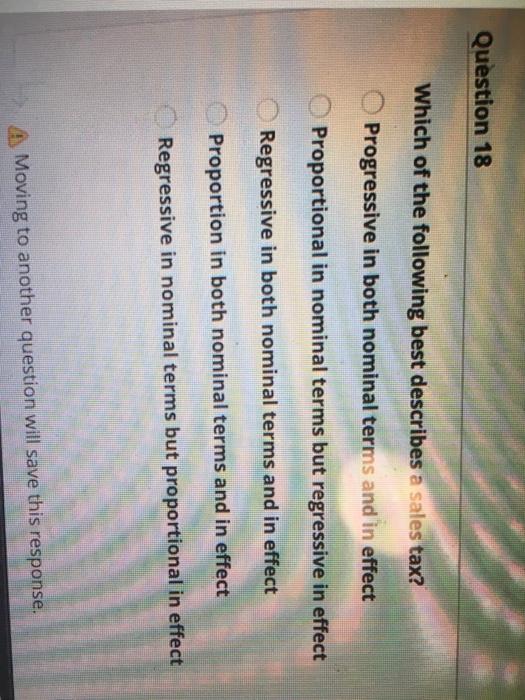

Which terms best describe sales tax. Iii Regressive taxes result in poor taxpayers paying no taxes. What describes a regressive tax.

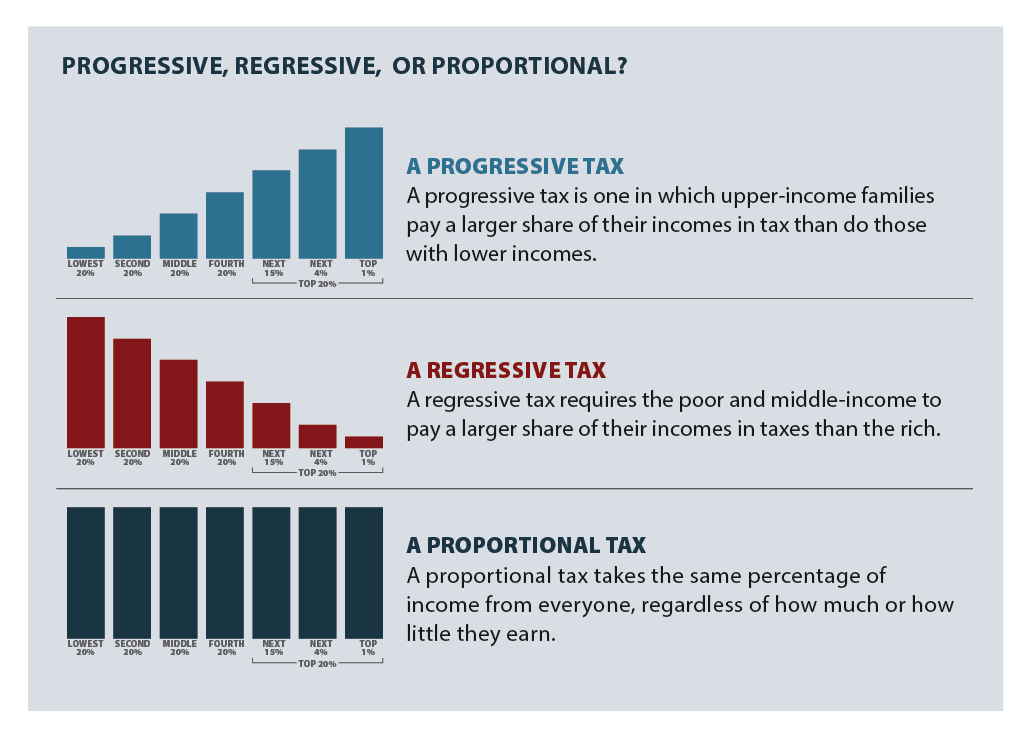

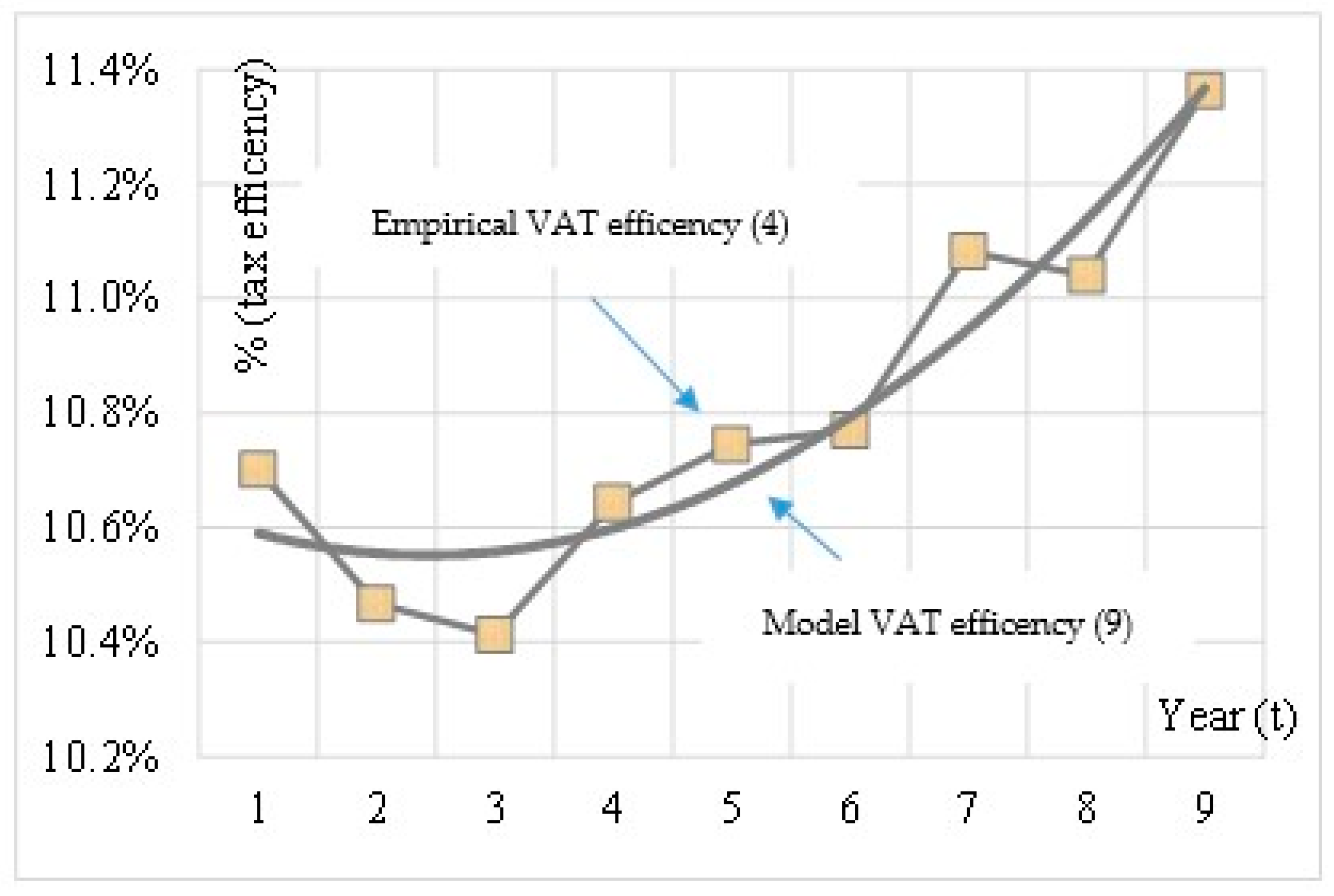

The most important regressive tax is the value added tax VAT in which a certain percentage of the price paid. February 28 2021 0 Uncategorized 0 Uncategorized. Ii Regressive taxes place a higher burden on wealthy taxpayers compared to people who earn less.

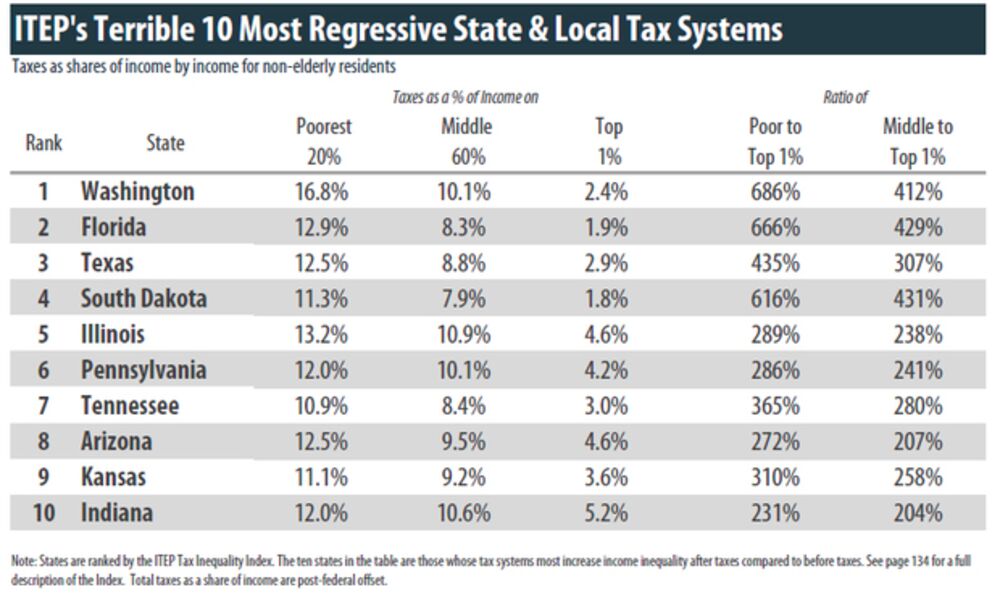

Regressive taxes result in poor tax payers paying no taxes. Which best describes a regressive tax. Since everyone pays the same sales tax rate someone who makes less money uses more of their income to pay the tax than someone who makes a higher salary.

In lower-income families a larger proportion of their income pays for shelter food and transportation. Answer Which best describes a regressive tax. A tax that charges high-income earners a lower percentage than low-income earners.

Which best describes a regressive tax. This kind of tax is a bigger burden on low-income earners.

Home Blog Uncategorized which best describes a regressive tax.

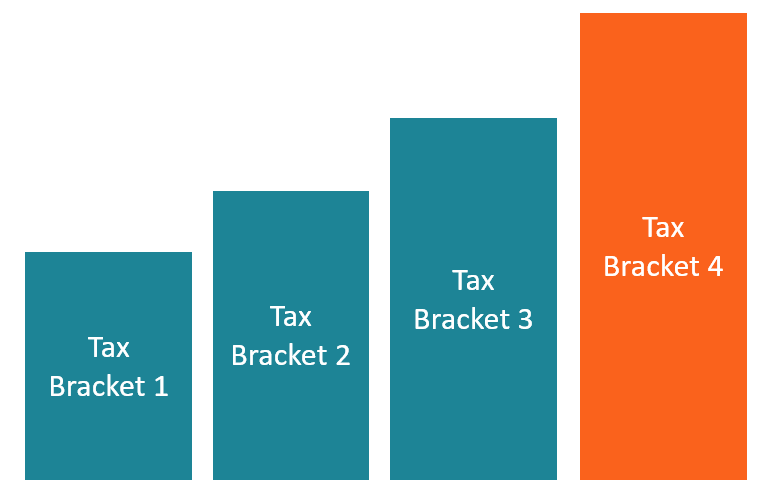

I Regressive taxes place a higher burden on people who earn less compared to wealthier taxpayers. Under this system of taxation the tax rate diminishes as the taxable amount increases. The most important regressive tax is the value added tax VAT in which a certain percentage of the price paid. To reduce pollution the _____ legislates and enforces regulations that. Regressive taxes place a higher burden on wealthy tax payers compared to people who earn less. If you earn 100 paying 1 as tax doesnt mind a lot to you but if you earned 10 it would mind much more. Ii Regressive taxes place a higher burden on wealthy taxpayers compared to people who earn less. I a tax that charges an equal percentage to all ii a tax that charges earners based on their professions iii a tax that charges lo. Therefore every person pays exactly the same but such payment means a higher burden for those taxpayers with a lower income.

LOGIN TO VIEW ANSWER. If you earn 100 paying 1 as tax doesnt mind a lot to you but if you earned 10 it would mind much more. Which best describes a regressive tax. Asked By adminstaff 22092019 0538 PM. What describes a regressive tax. That was part of the arrangement. Who is paying the tax.

/RegressionBasicsForBusinessAnalysis2-8995c05a32f94bb19df7fcf83871ba28.png)

Post a Comment for "Which Best Describes A Regressive Tax?"